Services

M&A Advisory

M&A Advisory

Introduction

Touchstone Advisors provides merger and acquisition services to the lower middle market, utilizing decades of experience in the industry to provide the best possible path for each owner and family business we represent. We customize our services based on your unique situation and we work closely with our clients to achieve their goals.

Three Main Components of Our Practice

COMPONENT ONE

Sell-Side Mergers and Acquisitions

We are experienced merger and acquisition advisors and M&A investment bankers who specialize in selling privately held businesses primarily with revenues between $5 million and $100 million. When it is time to sell your business, our process is designed to be thorough, confidential, and attract a large pool of qualified buyers — the result: maximum value for business owners.

- Competitive sell-side process resulting in multiple competing offers

- Exclusive Representation for Sellers & buyers

- Multi-Industry experience

- Sterling reputation

COMPONENT TWO

Exit Advantage

Exclusive 10 step program developed for business owners who have plans to exit in the next 2-5 years. The goal is to prepare the business for a future sale so that the transaction maximizes shareholder value.

- Owner Readiness Review

- Business Readiness Review

- Business and Financial Assessment

- Recast Financials

- Range of Value

- Tax Optimization

- Acquirer Risk Assessment

- Transition Options

- Value Enhancement ideas

- Bi-annual review

COMPONENT THREE

Buy-Side Services

Touchstone’s Buy-Side Services identify quality acquisition targets in the lower middle market.

Our process delivers:

- Preemptive “off market” deals

- Focused efforts leading to private one-on-one negotiations

- Multiple choices for investment

- Strategy-driven deals that add value on multiple levels

- Proven multi-step process that develops screening criteria to identify, select, and negotiate the best deal possible.

Creating Markets

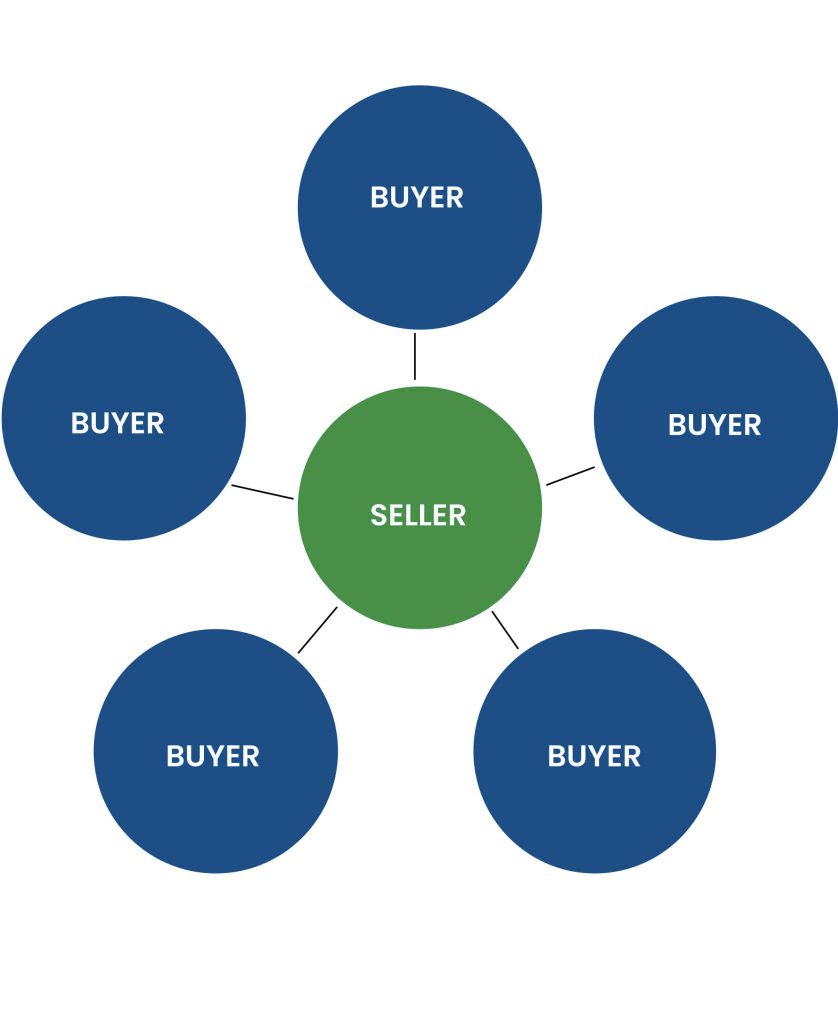

TOUCHSTONE ADVISORS CREATE A COMPETITIVE MARKETPLACE FOR YOUR BUSINESS

THE CONTROLLED AUCTION

Placing synergistic/strategic Buyers in competition with another will always produce a better price and terms for the Seller.

Our sealed bid process gives Buyers only one chance to submit their highest offer. This exerts upward pressure and essentially forces their hand to come in high rather than low as with a one-on-one situation. They simply can’t risk losing the opportunity to a competitor of theirs.

Three Marketplace Principles

Different buyers will pay very different prices for the same business.

The strategic buyer with the most opportunity will be able to pay the highest price

That strategic acquirer will never offer all the business is worth to them so long as they can buy the business at a lower price.

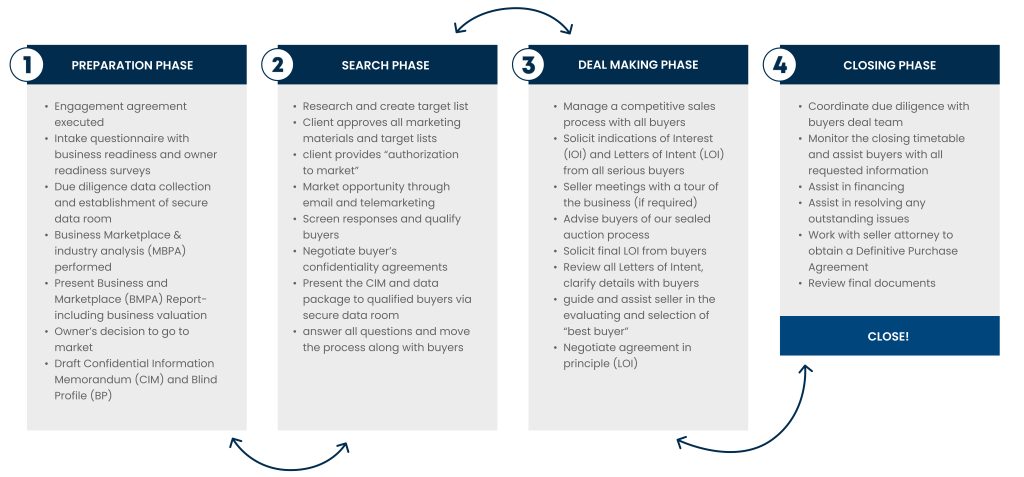

Our Process

Traditional negotiation tactics often lead to disadvantages for the seller. Our goal is to find the best buyers and use our competitive process to secure the highest and best offers.

The Touchstone Solution

Identify the strategic opportunities available to buyers in the market.

Market the business without a price to strategic and synergistic acquirers, private equity groups, family offices, individuals and others.

Identify acquirers that would benefit from those opportunities.

Place acquirers in competition with one another so that the highest possible selling price is achieved.

Estimate of Value

Estimate of Value

Touchstone’s Estimate of Value (EOV) provides owners with a realistic understanding of their company’s value in today’s marketplace. Our cost-effective EOV is a science and an art. By evaluating your company and the current market, we can help secure your company’s future.

We have more than 15 years’ experience in mergers and acquisitions and time-tested EOV procedures. We provide accurate, timely, and realistic information for well-informed business decisions.

Purposes and Uses

Our Estimate of Value allows us to evaluate your company’s position in the market and establish a realistic baseline indicator of your business’ worth if sold internally or to a third-party acquirer. This information is used for strategic planning when establishing the future of your company.

Our EOV process uncovers data crucial for:

- Evaluating exit options available to business owners

- Establishing a baseline value when buying or selling a business

- Transitioning internally to the next generation from current management

- Benchmarking and strategic financial planning

EOV Process

Step 1: Comparing Industry Business Sale Data

Our EOV process begins with multiple databases that detail company valuations and prices based on actual transactions in the private sector. The financial metrics we focus on include sales, gross profit, and adjusted cash flow-based earnings (EBIT and EBITDA).

Step 2: Internal Financial Model Used to Assess Market Value

Our internally developed financial model utilizes a private company specific cost of capital approach to help determine earnings multiples and, thus, value ranges. In addition to this financial analysis, we use sales data from the current market to help assess the fair market value of a business.

Step 3: Normalizing Adjustments

By utilizing financial statements previously prepared for tax reporting purposes, we adjust the evaluation to more accurately represent the value of a business to a third-party buyer. These adjustments are crucial to presenting a fair and complete view of the company on the market from an unbiased perspective.

Step 4: The End Result

The result of Touchstone’s EOV is a comprehensive report including every component we used to evaluate and arrive at our market-based recommendation. When working with larger companies, we often reach out to Private Equity Groups to request their opinion about the value of your company. These active financial buyers provide a range they would expect to pay for a business of your size, sector, and level of revenue and EBITDA, that we can incorporate into our report.

Investment Banking Services

Investment Banking Services

Touchstone Advisors provides investment banking services through Four Points Capital Partners, LLC, an independent broker-dealer. Touchstone provides personalized services with a focus on integrity and ethical conduct. Our investment banking team is highly skilled and, along with Four Points Capital, collectively touts over 100 years of banking experience resulting in billions of dollars in transactions. We partner with you to achieve your financial goals.

Equity Capital Advisory

Touchstone Advisors provides capital raise services and focuses on filling the gap for growth-oriented, emerging enterprises ranging from early-stage ventures to more mature, middle market companies. We work closely with individuals to secure equity capital to fund growth initiatives, recapitalize the balance sheet, provide a level of shareholder liquidity, finance M&A transactions, and support management buyouts.

Touchstone Advisors provides the following services:

- Convertible equity

- Preferred equity

- Venture capital

- Majority equity

- Minority equity

- Mezzanine debt

- Venture debt

Debt Capital Advisory

Touchstone Advisors advises both privately owned and sponsored companies to secure debt capital or leverage finance for organic growth, acquisitions, dividend recapitalizations, and refinancings. We work with each individual, optimizing debt structures and securing the best long-term partners for our clients.

Touchstone Advisors provides the following services:

- First-lien/senior secured loans

- Second-/split-lien facilities

- Mezzanine debt

- Unitranche facilities

- Asset-based loans (ABLs)

- Bridge and stapled financings

- Structured equity capital.

Four Points Capital

Four Points Capital Partners, LLC, is an independent broker-dealer whose mission is to provide financial services for individuals. Four Points Capital offers services including investment banking, asset accumulation, estate planning, sports advisory, institutional trading, wealth management, and more.

We partner with Four Points Capital because of our shared commitment to providing personalized financial services to our clients.