M&A Advisory

M&A Advisory

Introduction

Touchstone Advisors provides merger and acquisition services to the lower middle market, utilizing decades of experience in the industry to provide the best possible path for each owner and family business we represent. We customize our services based on your unique situation and we work closely with our clients to achieve their goals.

Three Main Components of Our Practice

COMPONENT ONE

Sell-Side Mergers and Acquisitions

We are experienced merger and acquisition advisors and M&A investment bankers who specialize in selling privately held businesses primarily with revenues between $5 million and $100 million. When it is time to sell your business, our process is designed to be thorough, confidential, and attract a large pool of qualified buyers — the result: maximum value for business owners.

- Competitive sell-side process resulting in multiple competing offers

- Exclusive Representation for Sellers & buyers

- Multi-Industry experience

- Sterling reputation

COMPONENT TWO

Exit Advantage

WExclusive 10 step program developed for business owners who have plans to exit in the next 2-5 years. The goal is to prepare the business for a future sale so that the transaction maximizes shareholder value.

- Owner Readiness Review

- Business Readiness Review

- Business and Financial Assessment

- Recast Financials

- Range of Value

- Tax Optimization

- Acquirer Risk Assessment

- Transition Options

- Value Enhancement ideas

- Bi-annual review

COMPONENT THREE

Buy-Side Services

Touchstone’s Buy-Side Services identify quality acquisition targets in the lower middle market.

Our process delivers:

- Pre-emptive “off market” deals

- Focused efforts leading to private one-on-one negotiations

- Multiple choices for investment

- Strategy-driven deals that add value on multiple levels

- Proven multi-step process that develops screening criteria to identify, select, and negotiate the best deal possible.

Our Process

Preparation Phase

Engagement agreement executed

Intake questionnaire with business readiness and owner readiness surveys

Due diligence data collection and establishment of secure data room

Business Marketplace & industry analysis (MBPA) performed

Present Business and Marketplace (BMPA) Report – including business valuation

Owner’s decision to go to market

Draft Confidential Information Memorandum (CIM) and Blind Profile (BP)

Search Phase

Research and create target list

Client approves all marketing materials and target lists

Client provides “authorization to market”

Market opportunity through email and telemarketing

Screen responses & qualify buyers

Negotiate Buyer’s confidentiality agreements

Present the CIM and data package to qualified buyers via secure data room

Answer all questions and move the process along with buyers

Deal Making Phase

Manage a competitive sales process with all buyers

Solicit indications of Interest (IOI) and Letters of Intent (LOI) from all serious buyers

Seller meetings with a tour of the business (if required)

Advise buyers of our sealed auction process

Solicit final LOI from buyers

Review all Letters of Intent, clarify details with buyers

Guide and assist seller in the evaluating and selection of “best buyer”

Negotiate agreement in principle (LOI)

Closing Phase

Coordinate due diligence with buyers deal team

Monitor the closing timetable and assist buyers with all requested information

Assist in financing

Assist in resolving any outstanding issues

Work with seller attorney to obtain a Definitive Purchase Agreement

Review final documents

CLOSE!

Three Marketplace Principles

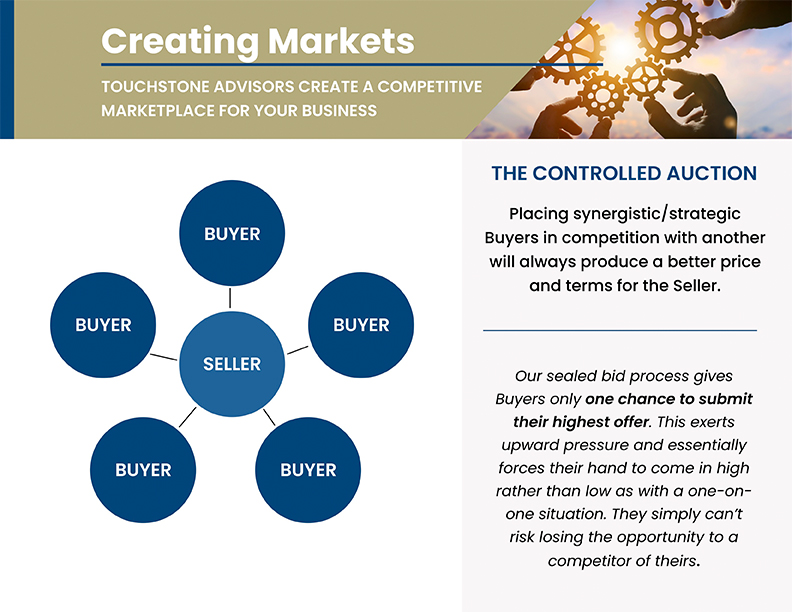

Different buyers will pay very different prices for the same business.

The strategic buyer with the most opportunity will be able to pay the highest price

That strategic acquirer will never offer all the business is worth to them so long as they can buy the business at a lower price.

Traditional negotiation tactics often lead to disadvantages for the seller. Our goal is to find the best buyers and use our competitive process to secure the highest and best offers.

Estimate of Value

Estimate of Value

Touchstone’s Estimate of Value (EOV) provides owners with a realistic understanding of their company’s value in today’s marketplace. Our cost-effective EOV is a science and an art. By evaluating your company and the current market, we can help secure your company’s future.

We have more than 15 years’ experience in mergers and acquisitions and time-tested EOV procedures. We provide accurate, timely, and realistic information for well-informed business decisions.

Purposes and Uses

Our Estimate of Value allows us to evaluate your company’s position in the market and establish a realistic baseline indicator of your business’ worth if sold internally or to a third-party acquirer. This information is used for strategic planning when establishing the future of your company.

Our EOV process uncovers data crucial for:

- Evaluating exit options available to business owners

- Establishing a baseline value when buying or selling a business

- Transitioning internally to the next generation from current management

- Benchmarking and strategic financial planning

EOV Process

Step 1: Comparing Industry Business Sale Data

Our EOV process begins with multiple databases that detail company valuations and prices based on actual transactions in the private sector. The financial metrics we focus on include sales, gross profit, and adjusted cash flow-based earnings (EBIT and EBITDA).

Step 2: Internal Financial Model Used to Assess Market Value

Our internally developed financial model utilizes a private company specific cost of capital approach to help determine earnings multiples and, thus, value ranges. In addition to this financial analysis, we use sales data from the current market to help assess the fair market value of a business.

Step 3: Normalizing Adjustments

By utilizing financial statements previously prepared for tax reporting purposes, we adjust the evaluation to more accurately represent the value of a business to a third-party buyer. These adjustments are crucial to presenting a fair and complete view of the company on the market from an unbiased perspective.

Step 4: The End Result

The result of Touchstone’s EOV is a comprehensive report including every component we used to evaluate and arrive at our market-based recommendation. When working with larger companies, we often reach out to Private Equity Groups to request their opinion about the value of your company. These active financial buyers provide a range they would expect to pay for a business of your size, sector, and level of revenue and EBITDA, that we can incorporate into our report.

Investment Banking Services

Investment Banking Services

Touchstone Advisors provides investment banking services through Four Points Capital Partners, LLC, an independent broker-dealer. Touchstone provides personalized services with a focus on integrity and ethical conduct. Our investment banking team is highly skilled and, along with Four Points Capital, collectively touts over 100 years of banking experience resulting in billions of dollars in transactions. We partner with you to achieve your financial goals.